Renters Insurance in and around San Francisco

San Francisco renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Home is home even if you are leasing it. And whether it's a house or a condo, protection for your personal belongings is beneficial, especially if you could not afford to replace lost or damaged possessions.

San Francisco renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

Renters often underestimate the cost of refurnishing a damaged property. Just because you are renting a townhome or space, you still own plenty of property and personal items—such as a desk, TV, cooking set, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why purchase your renters insurance from Adrienne Ng? You need an agent who is dedicated to helping you evaluate your risks and choose the right policy. With wisdom and competence, Adrienne Ng is here to help you keep life going right.

Get in touch with Adrienne Ng's office to see how you can save with State Farm's renters insurance to help keep your valuables protected.

Have More Questions About Renters Insurance?

Call Adrienne at (415) 292-8088 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

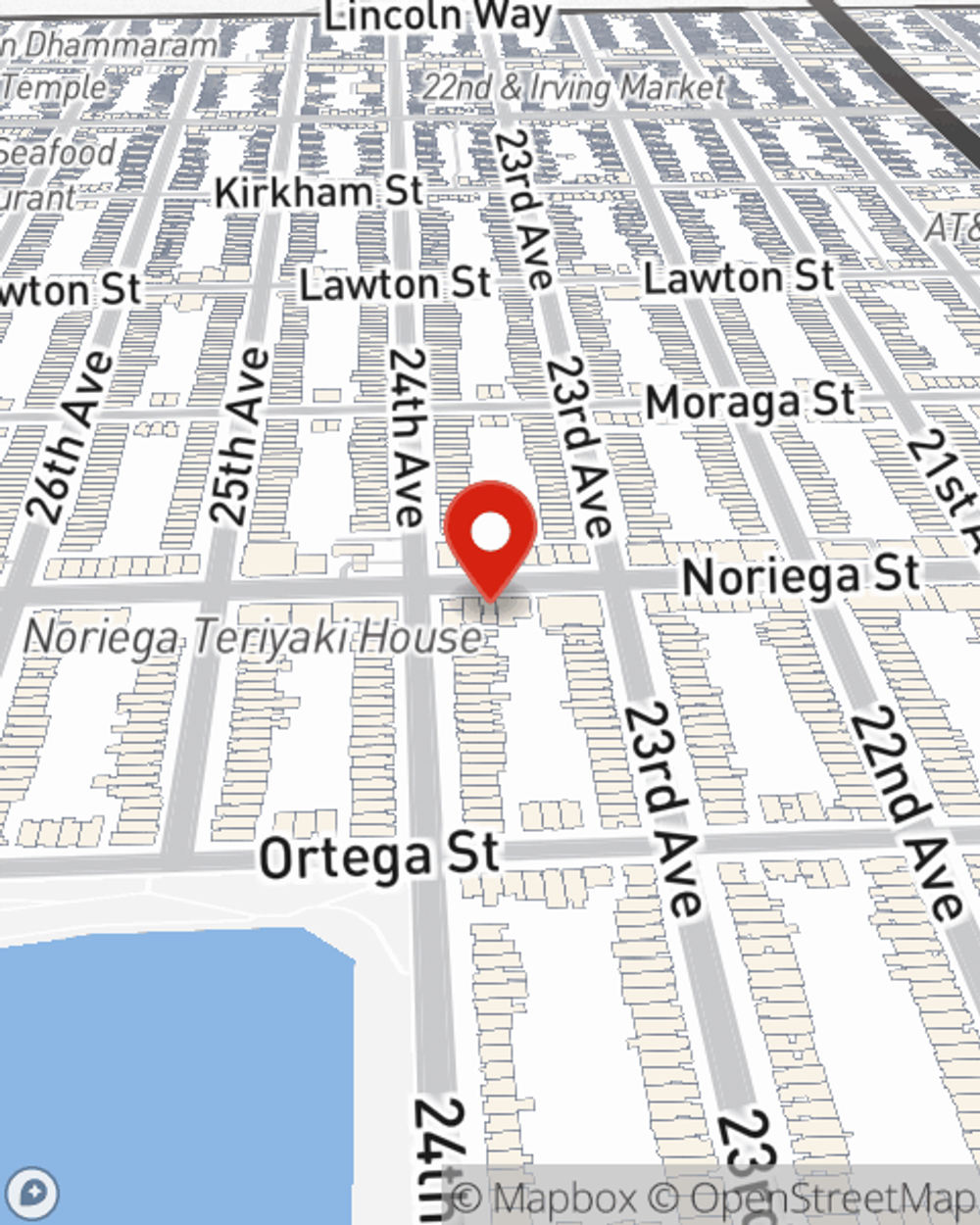

Adrienne Ng

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.